Family is a Valuable Asset

A long time ago, we started a portfolio from scratch.

We had to work out where the deals were, how to do them, and ensure the whole family were on board. Over the years, we’ve refined our unique insights, access, and knowledge – connecting us to better investment opportunities more often. Through our successes and mistakes, we've taught each other valuable lessons that have now reached the 4th generation. But we've always looked beyond our immediate circle to build a house of strong partnerships, that has seen our family grow in many, many ways.

A vision for a financially secure future

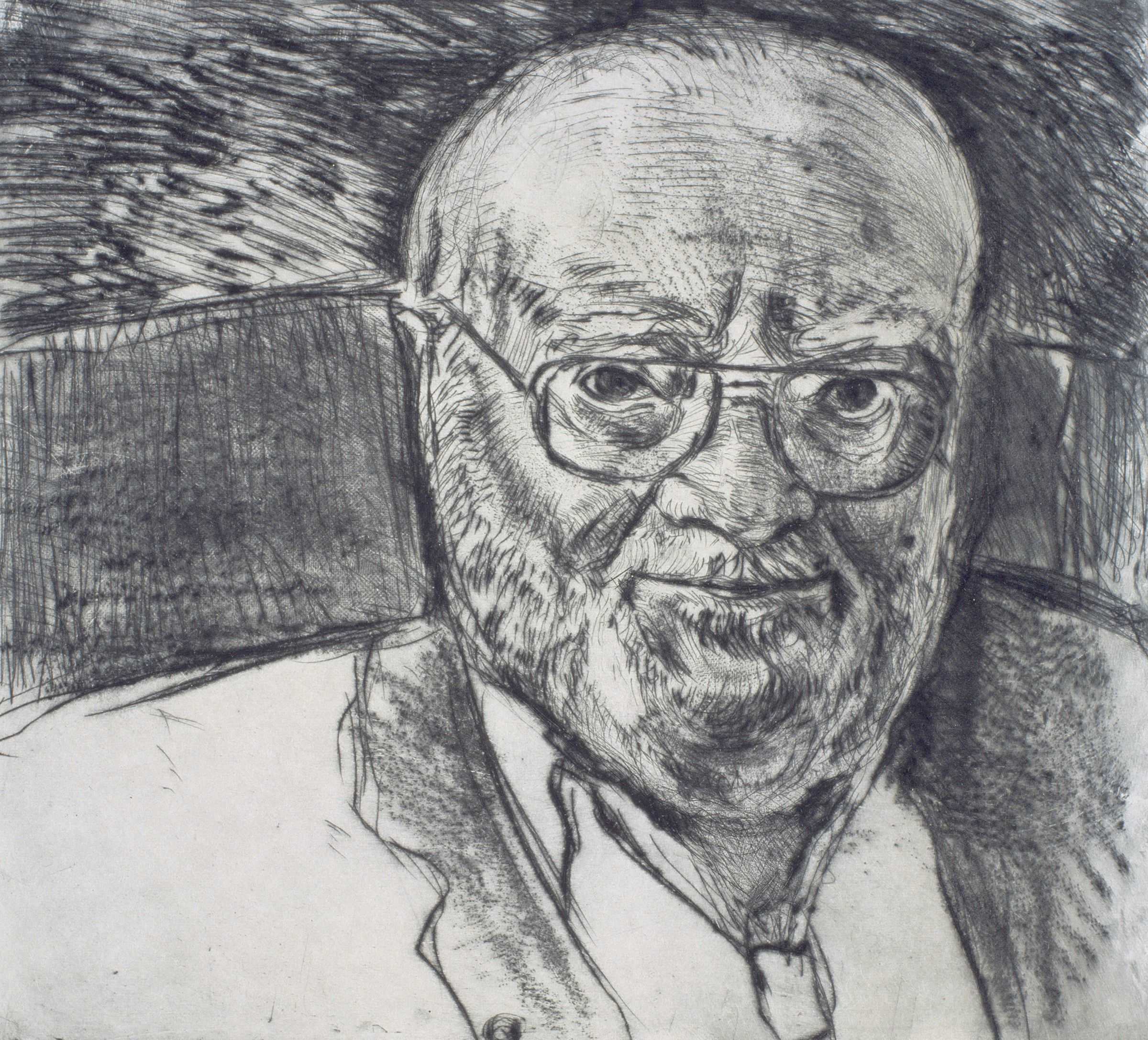

The Victor Smorgon Group was founded in 1995 by Loti Smorgon AO and Victor Smorgon AC, together with family members. Their joint aspiration was to grow and develop the family’s activities into another diverse empire to build generational wealth and look after the Smorgon family for years to come.

Victor Smorgon arrived in Australia with his father, Norman Smorgon, and family from the Ukraine, Russia in 1927.

During that same year, the family started a Kosher butcher shop in Melbourne on Lygon Street. Victor’s aptitude for business began at a young age and saw him, while working at the family butcher shop, setting up side ventures whenever he saw the opportunity.

In the 1930s, the family took on new projects, expanding into the wholesale meat and canning industries and by the end of the decade, they were exporting meat and canned fruit goods to the UK.

Smorgon Consolidated Industries

In 1942, Victor and the family group established Smorgon Consolidated Industries, which saw the start of the family’s real growth trajectory and as the business grew, so did the opportunities. The company would continue to expand and disrupt many industries over the next 50 years, competing against some of the major monopolies.

During the 1950s, the company branched out into more diverse operations, the first being the paper and packaging industry. By the mid-1960s, Smorgon Consolidated Industries moved away from fruit canning and focused on the growth of their paper business and in the 1980s, the family business expanded further with the purchase of a glass and plastic packaging company.

Smorgon Steel

It was around this time that Victor and the family took the opportunity to break the monopoly of the steel industry. Through innovative manufacturing methods and efficient technology, the Smorgon family succeeded in establishing a strong stake in the Australian steel industry, with the steel works becoming the major business focus of the company.

In 1994 the broader Smorgon family agreed to the divestment of Smorgon Consolidated Industries, and the meat, plastic containers, paper mills and recycling companies were sold.

Setting up the Victor Smorgon family office

After many years of success and different business activities, it was a natural progression for Victor to continue in family business, this time with his own company.

The Victor Smorgon Group was founded in 1995 by Victor, his wife Loti, their daughters and grandchildren. The family’s joint aspiration was to grow and develop the family’s activities into another diverse empire to build generational wealth and look after the Smorgon family for years to come.

It was Victor’s energy and vision that allowed both Smorgon Consolidated Industries and the Victor Smorgon Group to forge paths towards new and profitable ventures.

His keen sense of creativity and understanding of business helped the Smorgon name grow from the humble Carlton butcher shop into a thriving and constantly evolving family business across a variety of industries.

“Business is much more creative than

anything else in the world”.

— Victor Smorgon

Today, the Victor Smorgon Group continues to grow and evolve, as we follow new endeavours and continue to build on a range of successful businesses. With defined investment objectives and agreed expected returns, we diversify our portfolio and manage risk by maintaining exposure to multiple themes.

Current Investment Themes:

-

Gold

A strategic asset which performs well during periods of inflation and high debt, where gold producers possess strong fundamentals.

-

Emerging Markets

Investing in companies predicted to benefit from increasing discretionary consumer spend in developing economies.

-

Commodities

Companies involved with production, service or manufacturing across energy, industrial metals and agricultural sectors.

-

Energy

Investments which are leveraged to the energy transition taking longer than consensus & due to significant underinvestment over the past 10 years

-

Experiential Travel

Property offering hotel accommodation, experiences or general tourism.

-

Technology

Investments which are advancing productivity through innovation, including but not limited to, AI, Industrial Robotics, Quantum Computing and Cloud Software

-

Property

Buy and hold Multi Family – Residential Development where product is then held for sale then sold in bulk.

-

Consumer Discretionary

Investments where the customer is spending on items that are not: Shelter, food and core health.

-

Decarbonisation

Resources and related companies that will power the future energy transition and decarbonisation of the world.

Join the Legacy

Our investment method stems from our family philosophies, operational experience and our generational

style of investing and return expectations. Now you too can access these same opportunities and

experience high value investment returns.